The Window May Be Closing: 2018 Mid-Year Review

Every year we gather input from multiple sources for our mid-year review of the on-demand medicine space: retail clinic openings and closings; urgent care openings and closings; indications from payers as our clients work on contract renewals; reports and speeches from sources we trust on urgent care deal activity; and the many articles that cover high-level topics such as the move from fee-for-service medicine to value-based care.

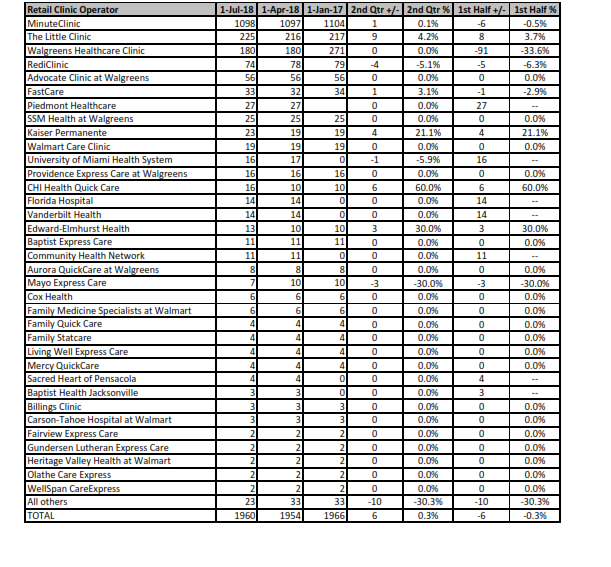

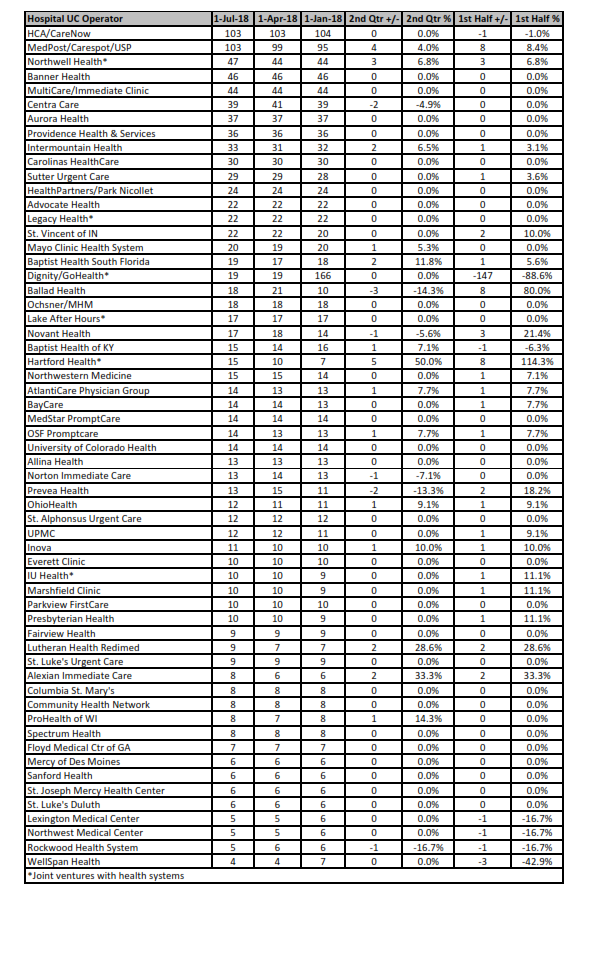

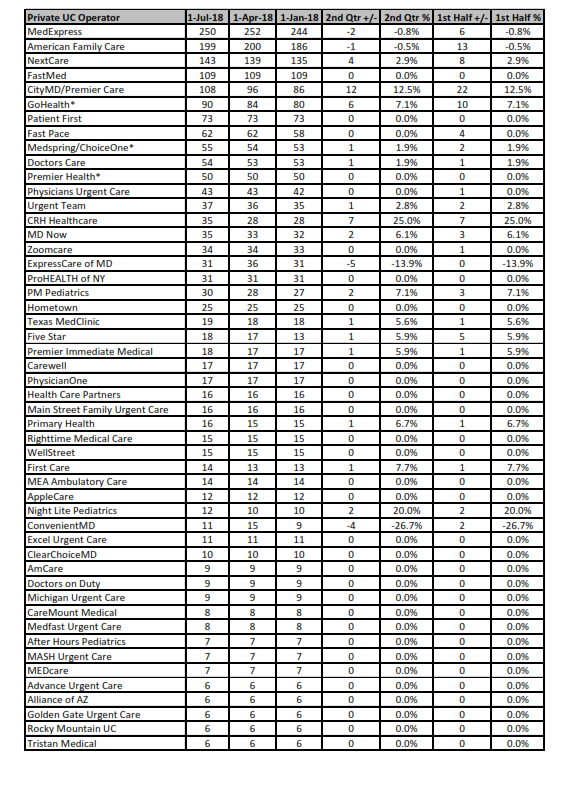

The most obvious measure of the on-demand space is the growth in urgent care clinics by the largest operators. Growth during the first half of 2018 was more than six percent, which on an annualized basis looks very good. Most of that growth came in the first quarter, however. What will be more telling is what growth looks like in the current quarter from July through September, a time when operators are opening new centers in time for the next busy season. Retail clinics in the first half saw virtually no growth, but that is a trend we’ve been seeing over the past two years. Updated tables for urgent care and retail clinic operators follow this article.

We are paying particular attention to the urgent care market in the third quarter since we see potentially important changes that may come sooner than later. We will cover these trends in more detail at our next Strategy Symposium January 21-23, 2019, at the Westin Fort Lauderdale Beach Resort. But here’s a preview of our observations:

First, over the next five years, many small private operators of urgent care centers risk getting squeezed out of the market in such a way that they have no choice but to sell at a fraction of what their centers were worth three to five years ago, or simply close their doors because they can’t afford to stay in business any longer.

Second, health systems and local hospitals have a window of opportunity in the urgent care space because payers have not squeezed them in the way that small private operators have been squeezed. The opportunity is not only to strengthen their position in the on-demand medicine space, but also to dip their toe deeper into the waters of value-based care. The smarter ones appear to be going “all in” on growth strategy here.

And finally, health insurance companies will continue to invest in on-demand brick and mortar because not only is it a way to directly reduce their emergency department (ED) costs, but it also represents a mass market of generally healthy individuals, i.e. the required “top of the funnel” for a strong population health strategy. These health insurance companies see the future of population health and value-based care much more clearly than health systems.

WHY PRIVATE OPERATORS GET SQUEEZED FIRST

Let’s be clear about one thing: the U.S. healthcare system is largely driven by our reimbursement system. As a small urgent care operator, you live and die by that reimbursement system. Until now, that system overall has treated urgent care operators moderately well. But ask any private operator, particularly the small ones, and they will tell you that is changing.

One major reason is what we call the shrinking available market delta. Merchant Medicine measures the annual available market of urgent care visits per thousand people in markets all around the country. The available market delta is the difference between the number of available urgent care visits (demand) and the number of visits removed from the available market by existing competitors (capacity). In most of the top 100 U.S. metropolitan areas, demand no longer exceeds capacity. Payers take that as a cue that they no longer need to increase their fee schedules. Meanwhile, urgent care operators are seeing significant labor cost increases for both providers and clinic support teams. It doesn’t take a rocket scientist to calculate that this could be an unsustainable economic model.

Added to this is the fact that ED visits have not dropped despite a dramatic increase in both retail and urgent care clinic sites throughout the country. The argument that urgent care is critical to lowering ED visits seems now to be falling on deaf ears.

And finally, there seems to be a continued preference for electronic medical record (EMR) interoperability, which seems only to exist among operators who use Epic. You need only look at CVS’ MinuteClinic as an example of an entity that saw Epic as the only true equivalent of interoperability. Thus they invested in that platform and now exchange medical records with health system medical groups virtually everywhere they have clinics.

Put all of this together and the big picture emerges: small urgent care operators are getting squeezed like they have never been squeezed before. The fallout has already started somewhat under the radar: ask any investment banker who operates in the urgent care space. But it is only a matter of time before we see a major correction and consolidation. Various large chains have had deals fall through, and some are looking to split up regionally to health system buyers.

Somewhat sheltered from this squeeze will be the large, multi-state operators who have established a strong footprint and large following of self-insured employers. And one could argue that MedExpress, the largest multi-state urgent care operator, doesn’t have to worry because it is owned by one of the largest payers in the U.S. But that isn’t quite accurate because Optum, the division that runs MedExpress, considers itself a multi-payer provider of healthcare services. Said another way, Optum tends to prefer markets where UnitedHealthcare does not have a stronghold.

OPPORTUNITY FOR HOSPITALS

Hospitals are the other major group of urgent care operators sheltered from the big squeeze. Hospital medical groups generally bundle their urgent care rate negotiations at the same time they negotiate their entire medical group rate structure, and sometimes their inpatient rate structure as well. That means urgent care is part of the totality of outpatient services, along with all of the multispecialty care they offer. So when payers negotiate with hospitals, they have to look past the current level of urgent care saturation. The result: hospitals are continuing to see fee schedule increases for their urgent care operations.

There is no guarantee that this will last. One of our speakers at the 2019 Strategy Symposium, Mai Pham, M.D., vice president of provider alignment solutions at Anthem, will talk about more aggressive moves by payers to push providers toward value-based care. This is where hospitals have a distinct advantage. Hospitals operate emergency departments. Those that operate urgent care centers have an opportunity to directly impact the number of non-emergent visits to that ED in a much more direct and sustainable way than private urgent care operators. We know payers would be open to a discussion that involved a risk arrangement for decanting that emergency department of non-emergent visits. And we expect more and more of these discussions to result in tangible reductions in ED visits, possibly in exchange for better urgent care rates.

FORMULA FOR SUCCESS

Back to the issue of labor costs versus reimbursement: this issue eventually will affect all urgent care operators, not just the small ones. If labor costs are going up and reimbursement is going down, how could this be anything but unsustainable? The answer is that reimbursement is only part of the top-line equation, just like price in a retail environment is only part of the top-line equation.

The missing part, of course, is volume. And despite the fact that most urgent care operators believe they are on the cutting edge of sophistication and efficiency, our view is that is far from the case. The truth is that most urgent care operators are desperate to keep up with recruitment. In an environment of provider shortages, turnover can be high. High provider turnover is the kiss of death for an urgent care center. It results in gross inefficiencies because of learning curves and personality adjustments. This causes slowdowns and increased wait times. High turnover also results in lowering the bar on who you hire, thinking that over time you can bring the new providers up to speed. But patients have a surprising sensitivity to competency in healthcare. Add it all up and you have a situation where satisfaction scores are dropping because urgent care is being dumbed down. Some urgent care centers no longer have full-time radiology technicians. Others have providers who don’t know how to suture. Patients who arrive needing imaging or suturing are sent to the nearest center where they have the staff to handle those cases.

So to say we have maxed out on our capacity to see more patients with the current staffing model is grossly inaccurate. We have barely scratched the surface when it comes to delivering efficient care for acute episodic injuries and illnesses, never mind employer services. This will be another topic we examine in detail at our next symposium, with two case studies from successful hospital urgent care operators.

TIME TO MOVE

It may be too late for smaller private urgent care operators to get ahead of these trends. But for health systems that are serious about making on-demand medicine a major part of attracting new patients into the funnel, there is a clear window of opportunity, although that window is closing. UnitedHealth Group has an innovation team that has hundreds of pilot projects from which so many programs are now maturing into long-term strategic assets. CVS Health and Aetna will likely be working on a whole host of initiatives in the on-demand space. Humana is looking at how they can jump in.

We believe that on-demand healthcare services will be a major piece of the value-based care formula. Our next symposium will be devoted to showing how and why that is likely to become reality sooner than later. Check out the details of the 2019 ConvUrgentCare On-Demand Strategy Symposium. Information on sponsorships is also available.

Quarterly Operator Listings

RETAIL CLINICS BY OPERATOR

JAN 1 – JUL 1, 2018

TOP HOSPITAL/MULTI-SPECIALTY GROUP URGENT CARE OPERATORS

JAN 1 – JUL 1, 2018

TOP PRIVATE URGENT CARE OPERATORS